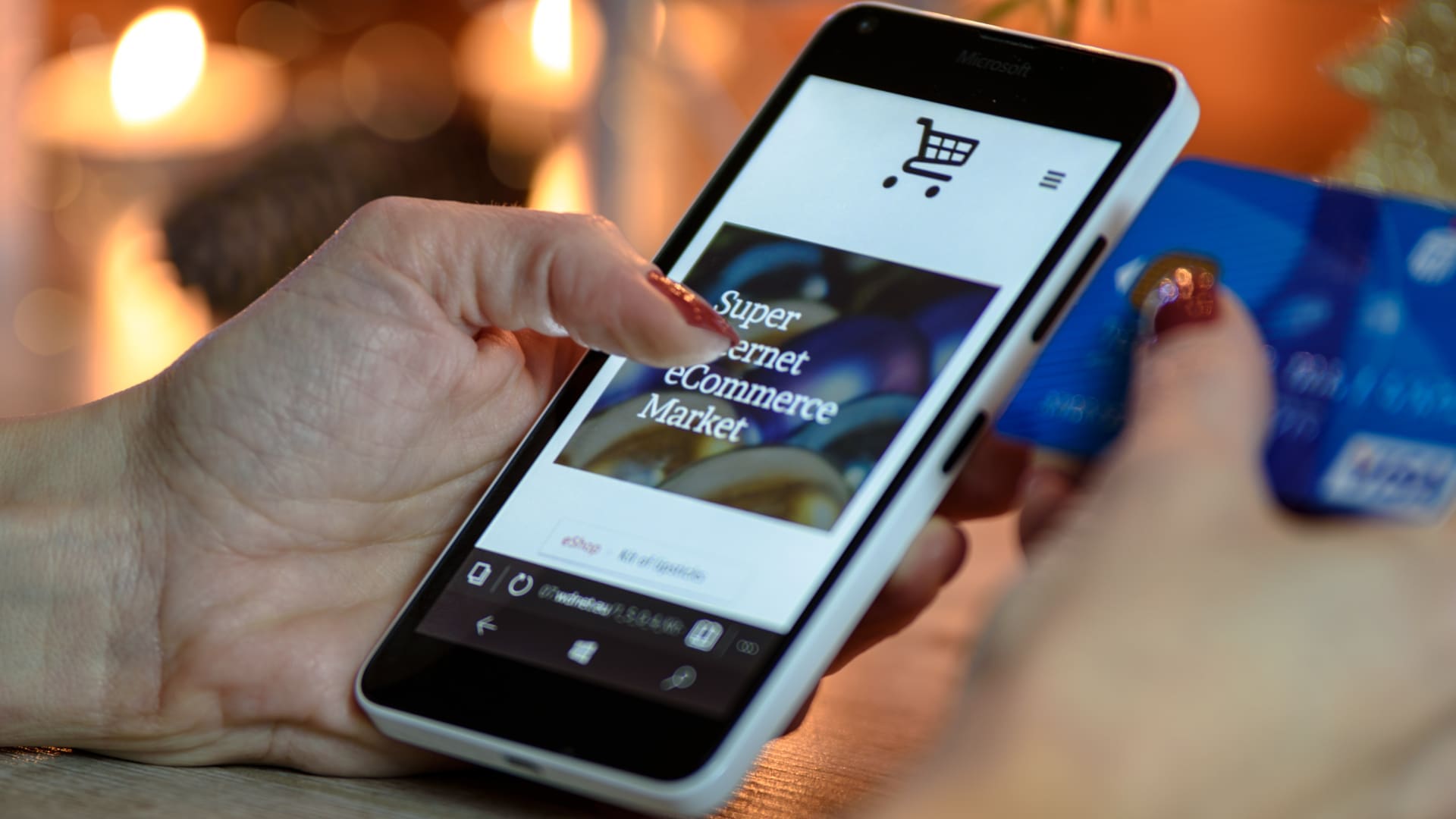

Has your business considered implementing mobile payments? Not only are these options fast growing and widely adopted, they are also incredibly efficient, fast, and convenient. Digital wallets, such as Apple Pay, are forecasted to become the world’s primary source of payments by 2030 according to experts. While it may seem like a while away, it’s better to be ready for this change now than later.

Here are a couple of reasons why you should consider mobile payments/digital wallets for your business:

1. Faster Checkout Speeds

Mobile payments are generally faster than using cash or debit. A single tap and you’re good to go! While this may seem small, the long-term benefits can be enormous. If, for example, you are a business that handles a lot of customers in a short amount of time, this increased checkout speed can ensure more of your customers are in and out of your door in no time. Coffee shops are a great example of this as they serve large quantities of young adults every day! No more counting change or finding the right card…simply have your customer pull out their phone and tap away!

2. Convenience

It’s not secret mobile payments are far more convenient than traditional forms of payment. In fact, this is one of the main reasons why younger customers are more likely to use them. By offering mobile payments, you can easily stand out amongst the competition simply because you are offering a more convenient experience.

Mobile payments even act as back ups for customers who may have difficulties with their cards. If, for some reason the magnetic strip on their credit card doesn’t work or perhaps the chip has worn out, customers can simply use their phones. Even wearable technology like Smart Watches can carry mobile payment options, further elevating the convenience factor by having a payment method ready to go on their wrists.

3. Security

It is not often expressed how easily credit card machines can succumb to fraud. Bad actors may easily compromise the security of your credit card machines, and the blame would ultimately fall on the business. The customer will have a headache and your business is likely to lose some reputation.

Mobile payments have extra layers of security that other payments do not. Biometrics are a common method of preventing credit card information from being leaked or stolen. Finger prints of a facial scan are often needed to ensure a transaction can even take place. So not only will this make it harder for bad actors to steal information, it also ensures that the customer must go through several layers of approval before finishing their transaction, lessening the risk of fraudulent purchases or mistakes.

While this added security isn’t 100% air tight, it does cause the impact caused to customers be much smaller.

4. Easier book-keeping

While mobile payments offer a bevy of convenient features for customers, your business can rest easy knowing there is one massive benefit you can enjoy. It is much easier to collect sales information, keeping track of customer trends, and share payment records with your accountant when you accept mobile payments. When combined, you are sure to experience an increase in productivity and efficiency. On top of that, mobile payments often do not come attached with the various bank processing fees that are often associated with debit and credit payments. Mobile payments may not be 100% free from processing fees, but they are significantly lower.

Do you think you’re ready to accept mobile payments? Do these benefits sound alluring enough for you? It shouldn’t be a surprise when you improve your businesses technological prowess, you also reap major benefits, especially in an increasingly digital era. Hopefully this will give you enough to consider a full mobile payment solution for you own business in the near future!

Because if not now….when?