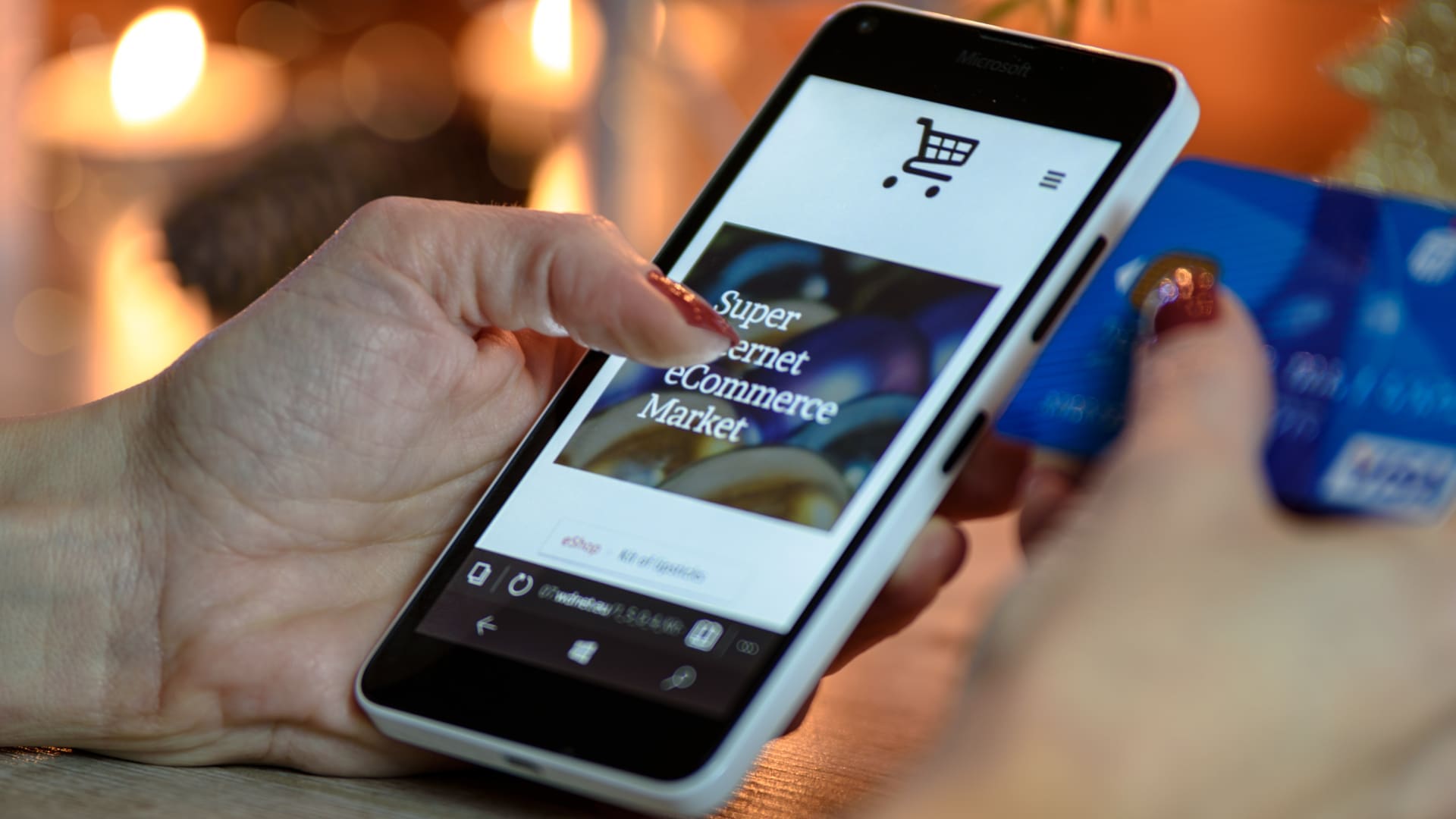

Being labelled as a high-risk merchant can have its consequences.

As a business owner, you may have heard of the term “high-risk merchant accounts”. This is often associated with online card payments is applicable to your operational finances. High risk merchant accounts can affect your online payment processing fees, so it’s best to be knowledgeable about the impacts this label may cause.

What is a High-Risk Merchant Account?

To put it simply, a high-risk merchant account is a label that your processor may require you to operate under. This is often related to high risk chargebacks and fraud but can also be related to subscription fees, high transaction sizes, and long fulfillment time frames.

What Makes Your Business High Risk?

Since there is no governing body that decides what is considered high-risk, it is ultimately up to the processor’s policies and what they consider high-risk factors. This may include the following:

- Subscription fees

- Poor credit

- Low business experience

- High sales volumes

- Being on the MATCH (Member Alert to Control High-Risk Merchants) list

- Long fulfillment times

- Illegal activity and history of fraud

- Large number of card-no-present transactions

This list only covers some of the more common factors that processors use to label high-risk merchants. Be sure to ask your processor what they consider high-risk behaviour and understand what they need from your business to avoid such a label.

High-Risk Industries

There are a number of industries that often have a higher likelihood of being labelled as high-risk. Check our list below to see if your business applies:

- Online gaming and casinos

- Travel and vacation

- Dropshipping

- Weight loss and dieting

- Online dating services

- Automotive parts and accessories

- Regulated industries (alcohol, tobacco, marijuana, firearms)

- Bail bonds

- Adult products and services

- Debt collection

- Credit repair

These industries are just a small sample of what some processors may consider to be high-risk. Always check with your processor if your business falls in any high-risk categories.

How Can High-Risk Labels Affect Your Bottom Line?

Being labelled as a high-risk merchant can bring unwanted repercussions to your bottom line. Processors may have lengthier application processes as well as higher fees if you are labelled as high-risk. Additionally, chargeback fees may increase and processors may hold onto some of your revenue as a hedge. These can be highly detrimental to your bottom line, especially if you’re a brand new company looking to get your foot through the door. Being labelled as high-risk will introduce these hurdles that you will have to adapt towards.

What Can Be Done?

As a business, you should always have a card processor. This means you won’t be able to control the variables that may mark you as a high-risk merchant. However, there are several steps you can take to try and mitigate this problem and reduce your risk level.

First, you may want to look into policy changes that will help reduce chargeback levels. You may also investigate improving multiple aspects of your business, such as fulfillment times, to help reduce your risk level. Improving your credit rating can also provide positive benefits to your risk level. If youa re looking to sign a new contract with a processor, be mindful that they may be looking to lock you into a long-term fee. You should want to review your processor agreement with an independent party, such as Watchdog Management Services, to see if there is any way you can get a better contract and save in the long-run.

In the end, each processor will have different rules for what makes a merchant high-risk. You should always check with your processor so you can understand what you need to do to avoid this label. You don’t want your processing fees and business profitability to be affected after all!